The Algorithm of Wealth

I remember my first paycheck, free money I thought! Then the bills arrived, and suddenly that freedom felt a lot more constrained. I graduated university with £50k in student loans, and almost little to no savings. This project was created from my journey from financial chaos to clarity.

I stumbled upon the r/UKPersonalFinance reddit community, a treasure trove of practical advice on managing money in the UK. They advocate a structured approach to personal finance, breaking it down into clear, actionable steps. Some of the resources I found particularly useful were:

I had started using the spreadsheet to track my finances, however I found that it kept breaking as I used it month by month. This was mostly due to my user error, however I kept thinking there must be a better way. This frustration led me to create Networth, a tool to automate and visualize my financial data.

The following are the the principles I have used over the years to build a solid financial foundation, inspired by the UKPF flowchart.

I am not a financial advisor. This is not financial advice. This is simply the strategy that has worked (so far) for me personally. Please do your own research and consult a professional before making any financial decisions.

Pay Yourself Last

Most people pay themselves first. They get their monthly or weekly income, and live by the day, spending what they need on all types of expenses: food, rent, entertainment, etc. The problem with this approach is that, by the end of the month, they realised - "oh, I need to put some money into savings". But by then, there is often little to nothing left to save.

If you pay yourself last, you are forced to budget for your future first. This reframes your mindset from "I hope I can save something" to "I have already saved, now I can spend what's left".

Your savings aren't money locked away; they are planned spending for your future. This framework is designed to help you structure your finances so that your future is funded before your current self starts spending. It prioritizes your financial health so that investing becomes a non-negotiable bill, not an afterthought.

Building the Foundation (The Budget)

Before we can optimize anything, we have to know what we're working with. Creating a budget is the first step in understanding your cash flow. Track your income and expenses for at least one month. This will give you a clear picture of where your money is going.

If you're spending more than you earn, no algorithm can save you. It’s like trying to fill a bathtub with the drain open you have to close the plug first.

You cannot optimize what you do not measure. Tracking gives you the control to make choices.

The "Sleep Well" Fund

Risk Mitigation

Life is unpredictable. Cars break, boilers burst, and jobs change. Having a small cash buffer could be the difference between a minor inconvenience and a financial crisis.

Imagine you loose your job tomorrow. How much money do you have in the bank to cover your essential expenses until you find a new one? On average it takes about 3 months to find a new job, so doubling the number of months is a good target. Just in case.

Free Money (Employer Match)

The Infinite ROI

You should think of this like a cheat code - its free money afterall. If your employer offers to match your pension contributions, grab it with both hands.

- You put in: £100

- Employer puts in: £100

- Total: £200

- Instant Return: 100% (Risk-free).

There is literally no other investment on earth that doubles your money the moment you sign the paper. It's the highest priority for a reason.

Killing the Parasites (High-Interest Debt)

The Guaranteed Return

Debt can feel heavy, like a weight you drag around every day. Mathematically, paying it off is the best investment you can make.

Think of it this way: The stock market might give you 7% this year. But your credit card is definitely taking 20% from you.

- Market Return: ~7-10% (Maybe).

- Credit Card Debt: 20% (Guaranteed Loss).

Paying off a £1,000 debt at 20% is exactly the same as finding an investment that pays you a guaranteed, tax-free 20% return. Lets eliminate guaranteed losses before chasing uncertain gains.

Bulletproofing (Full Emergency Fund)

Stability

Once the toxic debt is gone, it's time to build a fortress. The goal here is 6 months of expenses.

This isn't just about money; it's about psychology. Knowing you can survive a job loss or a major life event without panic allows you to make better long-term decisions. You stop operating from a place of fear.

This could go into a high-interest savings account or an easy-access cash ISA. The key is liquidity - you need to access it quickly without penalties.

Saving for the Fun Stuff

Liquidity (< 5 Years)

We all have goals: wedding, house deposit, dream trip. If you need the money in the next few years, the stock market is a risky place to keep it.

The market is volatile. In any given year, it could drop 30%. If that happens right before you need to pay your deposit, you're in trouble.

- Short Term: Keep it safe (Cash/Bonds).

- Long Term: Let it grow (Equities).

Planting Trees (Long-Term Investing)

Compound Growth

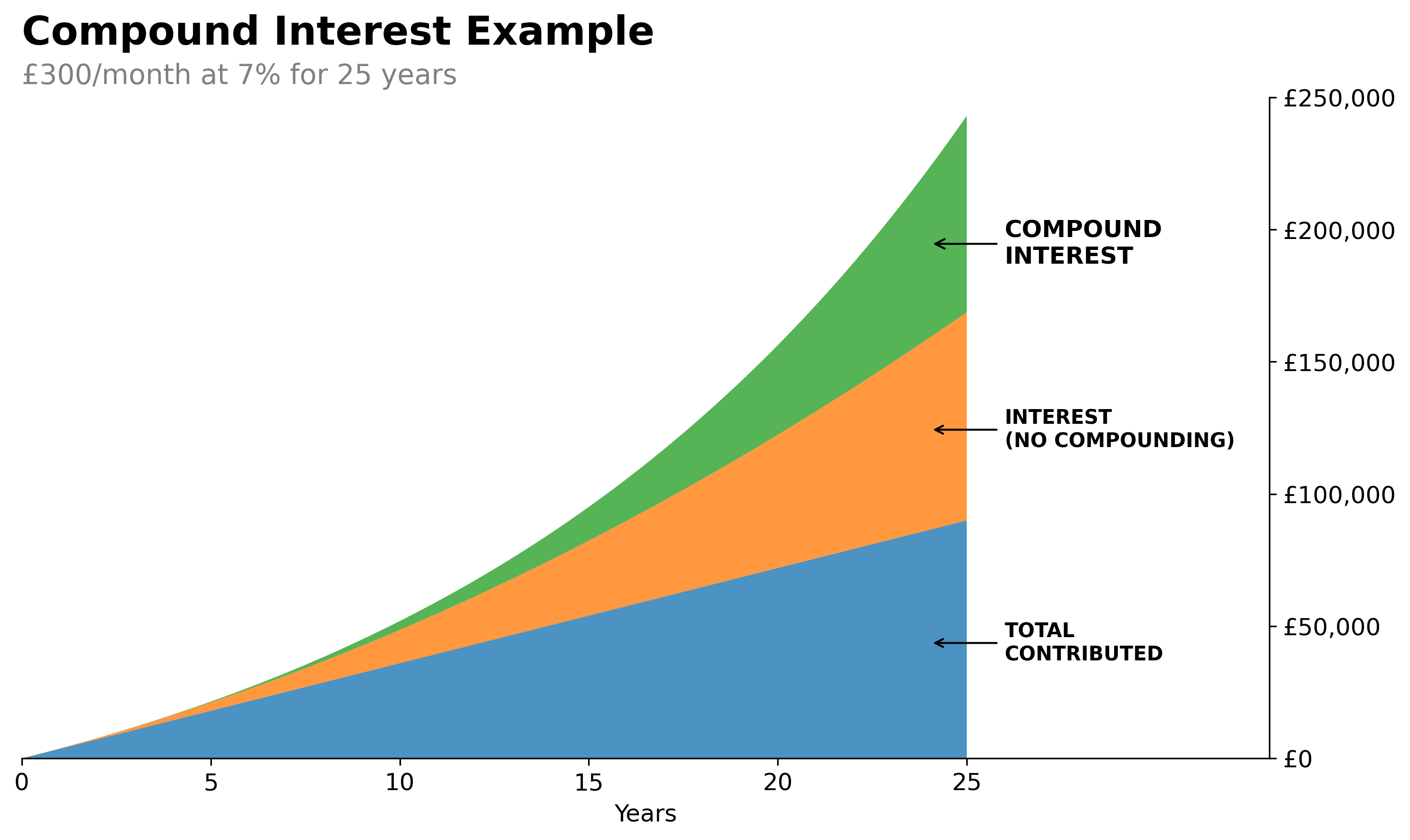

This is where the magic happens. This is the "FIRE" (Financial Independence, Retire Early) engine. Once your foundation is solid, you can plant seeds that will grow into forests.

Now imagine extrapolating this over decades. The growth becomes exponential. Your money starts making money, which then makes more money. This is the power of compound interest. The earlier you start, the more time your money has to grow. Even small, consistent contributions can lead to significant wealth over time.

Where:

- FV: Future Value (What you will have)

- PV: Present Value (What you have now)

- r: Interest Rate (How fast it grows)

- n: Time (How long you leave it)

The earlier you start (), the more powerful this becomes.

Year 1-10: The sapling grows slowly. You barely notice it. Year 20+: The tree is massive, growing more in a year than it did in its first decade.

Project Networth

I built Networth because I wanted to see this journey clearly. I wanted to see my debts shrinking and my "trees" growing.

- Aggregate your data so you can face the truth.

- Analyze your spending to close the drain.

- Visualize your trajectory to stay motivated.

It’s a long climb, but the view from the top is worth it.